Gnosis Chain Warns of Validator Penalty Post Balancer Hack Recovery Hard Fork

Gnosis Chain GNO $122.2 24h volatility: 1.1% Market cap: $322.30 M Vol. 24h: $5.82 M executed, on December 22, a governance-approved hard fork to recover around $9.4 million of the frozen funds from the Balancer hack.

Passed one day of the execution, the Gnosis official account warned “remaining validators” to upgrade and “avoid penalties.”

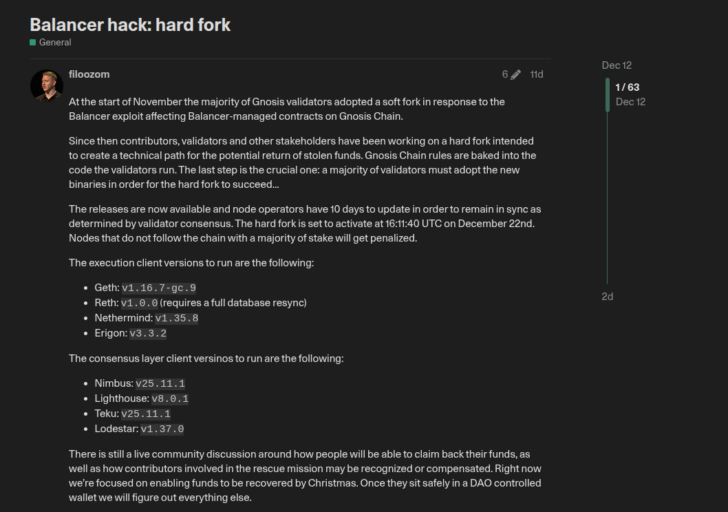

On December 12, Gnosis’ head of infrastructure Philippe Schommers explained in a governance forum post that “contributors, validators and other stakeholders have been working on a hard fork” to recover funds previously frozen on the Gnosis Chain.

The freezing happened following a validators-approved soft fork in November 2025, addressing part of the funds identified as belonging to the Balancer exploit’s attacker.

Balance hack: hard fork proposal on Dec. 12, 2025. | Source: Gnosis Governance Forum

As planned, Gnosis node operators had ten days to upgrade, executing the hard fork that allowed for the funds’ seizure.

Earlier this year, the Sui SUI $1.43 24h volatility: 2.5% Market cap: $5.35 B Vol. 24h: $535.90 M network faced a setback following the CETUS hack.

The Sui Foundation, Cetus Protocol, and OtterSec gained community approval to use a special signature to seize the attacker’s funds, recovering part of the losses.

Following this series of developments, the Gnosis Chain has now posted a warning on X to all “remaining” validators to upgrade their nodes accordingly.

Not upgrading would result in penalties, executed via the GNO token. The penalties can range from not receiving staking rewards to potentially leading to slashing in extreme cases of prolonged non-participation or if interpreted as disruptive behavior.

Divided Reactions

Despite the reported approval, Gnosis’s decision has divided opinions, with some praising transparency and others criticizing the breach of immutability.

Ignas DeFi commented on the matter, mentioning this hard fork sets precedents for future decisions.

“But this fork sets a big precedent: Do we hard fork for every hack? Only if losses > 5% of TVL? Why not 3%? Can app devs start assuming the chain will step in if they mess up, lowering security standards?” He noted that “The hard fork and the debate will end up setting hard-fork precedent rules for other chains to follow”.

In one of his related posts, however, he explained that the soft fork already broke Gnosis’ neutrality and claimed that other chains took similar decisions around the Balancer hack.

“We’ve already seen similar censorship interventions elsewhere,” Ignas said, pointing out “Berachain and Sonic after the same Balancer hack, and Sui after the $162M Cetus exploit.”

The Balance V2 Hack and Gnosis

The referenced incident involved a Balancer V2 Protocol exploit that drained approximately $128 millionacross affected pools. This was not a chain-specific hack, but a protocol exploit that affected multiple chains, including Gnosis.

Harry Donnelly, founder and CEO of Circuit, called Balancer’s breach “a serious warning” for the DeFi ecosystem, noting that this was “one of the most trusted names in the space” and “an early pioneer with a culture of compliance, backed by rigorous audits and open disclosure,” according to a report by The Defiant.

nextThe post Gnosis Chain Warns of Validator Penalty Post Balancer Hack Recovery Hard Fork appeared first on Coinspeaker.

Ayrıca Şunları da Beğenebilirsiniz

PEPE and Memecoins Are Back Where 2,500% Rallies Began

Momentum builds as price holds above 0.6600