Senior US Democrats warn: Trump could cause another "catastrophic crash" in the crypto market

PANews reported on October 22nd, according to DL News, that the cryptocurrency crash has become a political issue in the United States. Democrats are warning that the government shutdown could trigger another market disaster, and that the paralysis of federal regulatory agencies has exposed investors to significant risks. Maxine Waters, the top Democrat on the House Financial Services Committee, issued a statement on the 21st day of the shutdown, blaming Republicans. She said that Trump and congressional Republicans are integrating cryptocurrencies into the traditional financial system without an appropriate regulatory framework, amplifying risks and threatening to cause similar crashes to spread more quickly to the traditional financial sector in the future. Following the October 10th market crash, Waters stated that the sell-off cost investors billions of dollars and drove traders into traditional safe-haven assets.

Furthermore, the flash crash sparked calls for an investigation into insider trading after analysts discovered a single wallet deposited millions of dollars into the Hyperliquid decentralized exchange shortly before the crash. This wallet established significant leveraged short positions in Bitcoin and Ethereum, allegedly profiting over $150 million after the price crash. Waters called on the SEC and CFTC to conduct a thorough investigation and hold the perpetrators accountable. However, with these institutions effectively stagnant, investors have lost key protections and are "extremely vulnerable to another catastrophic crash."

You May Also Like

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification

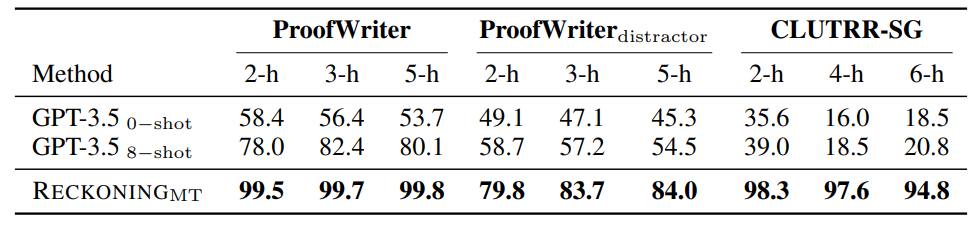

The Strength of Dynamic Encoding: RECKONING Outperforms Zero-Shot GPT-3.5 in Distractor Robustness