DePIN

Share

DePIN utilizes blockchain and token incentives to build and maintain physical infrastructure, such as wireless networks, cloud storage, and energy grids.By decentralizing the ownership of hardware, projects like Helium and Hivemapper disrupt traditional centralized monopolies.In 2026, DePIN is a core pillar of the Web3 + AI economy, providing the decentralized compute and data collection necessary for autonomous agents. This tag tracks the growth of hardware-based rewards, crowdsourced infrastructure, and the democratization of global utility networks.

1503 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

ZIONS BANCORPORATION ANNOUNCES PRICING OF SENIOR NOTES

2026/02/05 07:45

Recovery extends to $88.20, momentum improves

2026/02/05 07:34

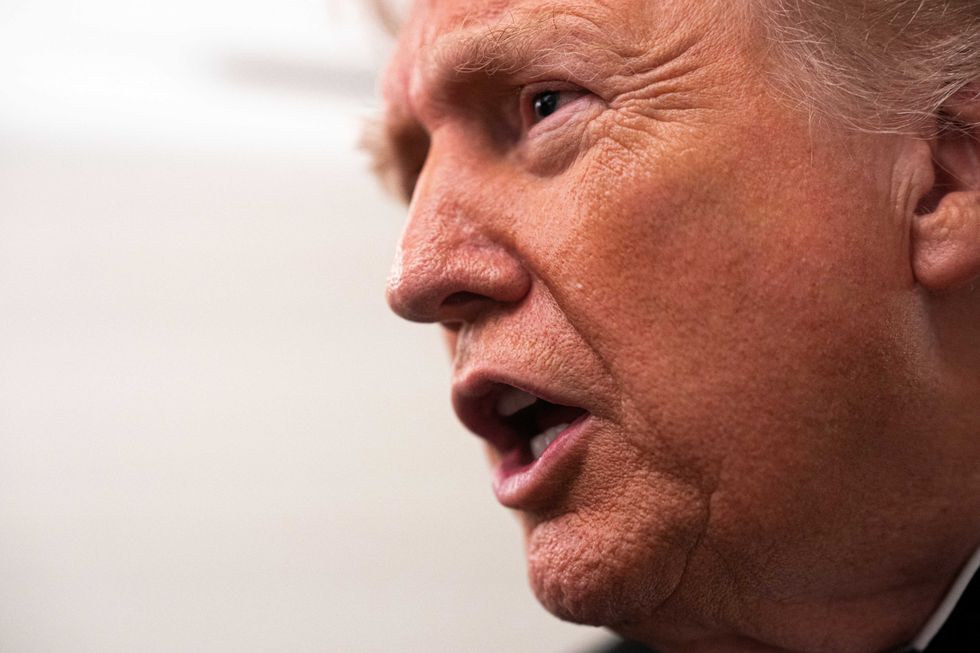

Trump lawyers get an earful from judge over desperate new move: 'Two bites at the apple'

2026/02/05 07:15

VIRTUAL Weekly Analysis Feb 4

2026/02/05 06:48

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

2026/02/05 03:49