DEX

Share

DEXs are peer-to-peer marketplaces where users trade cryptocurrencies directly from their wallets via Automated Market Makers (AMM) or on-chain order books. By removing central authorities, DEXs like Uniswap and Raydium prioritize privacy and user sovereignty. The 2026 DEX landscape is dominated by intent-based trading, MEV protection, and cross-chain liquidity aggregation. Follow this tag for the latest in on-chain trading volume, liquidity pools, and the technology behind permissionless swaps.

34868 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

“cnjrefcod” 30% Off Trading Fees

2026/02/07 06:42

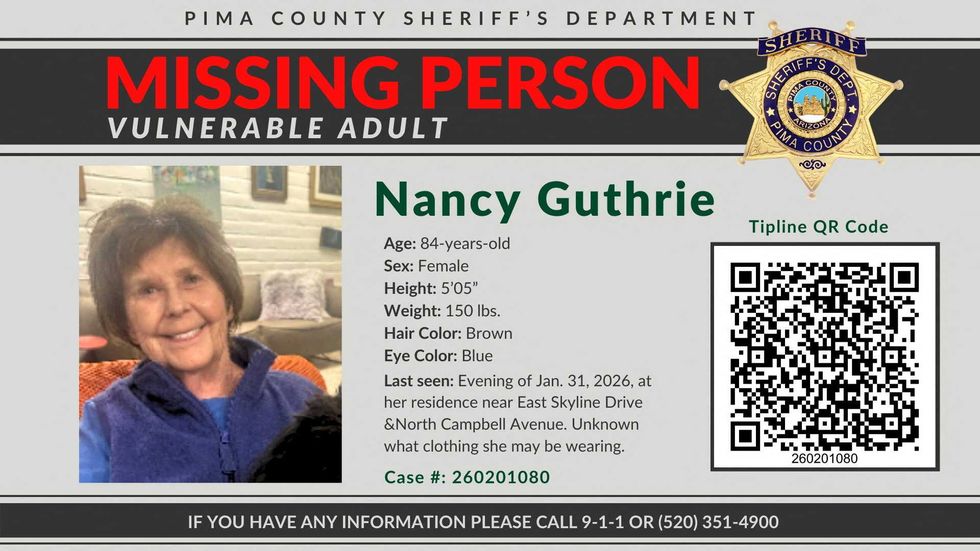

New note emerges in abduction of Nancy Guthrie

2026/02/07 06:32

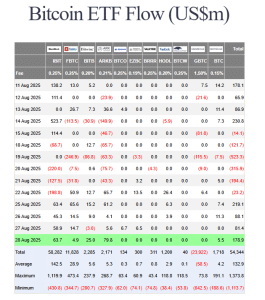

Stablecoin Inflows Surge as Bitcoin Struggles Under Persistent Selling Pressure

2026/02/07 06:04

XRP snaps back after near-20% sell-off as volatility dominates post-crash trading

2026/02/07 06:03

Stellar (XLM) Jumps 7% as $0.183 Breakout Signals Potential Reversal

2026/02/07 06:00