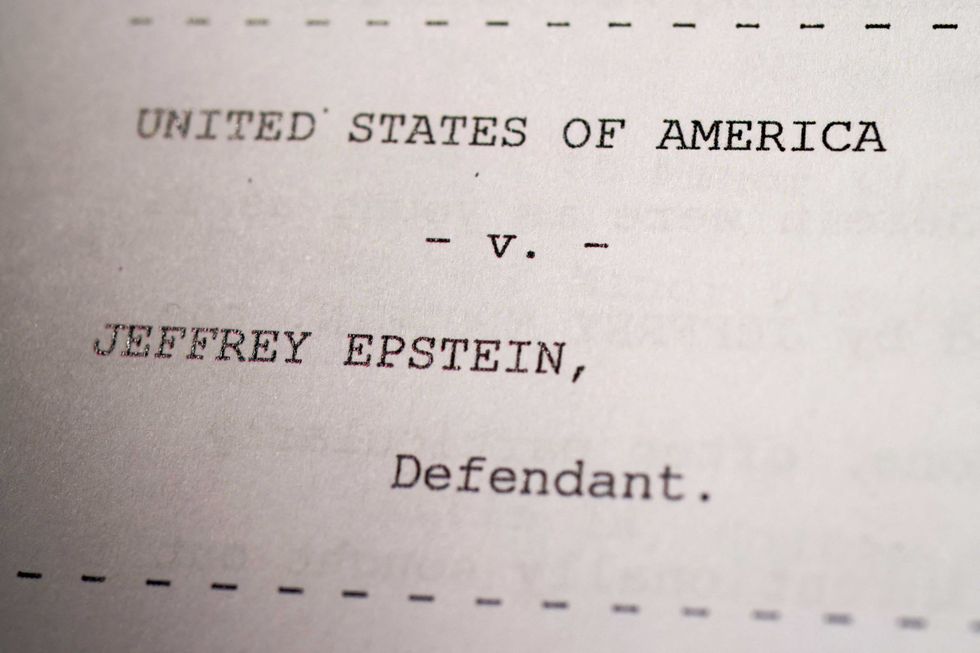

Highlights: The Canary Capital files an S-1 with the SEC regarding the Trump coin ETF. The Trump coin ETF is designed to give exposure to the Solana-based $TRUMP token. The review process starts once a 19b-4 filing is submitted. Canary Capital Group LLC, an asset management firm, has formally submitted an S-1 form with the U.S. SEC pertaining to its Trump coin ETF. This move comes after its Delaware registration, which shows an increased commitment to the project. The ETF will be able to provide exposure to the $TRUMP memecoin, which is a token that runs on Solana and has ties with the U.S. political culture. One day before the application, the company also applied for an “American-Made Crypto ETF.” This demonstrates a more comprehensive plan to increase its suite of crypto ETFs. Overall, Canary has multiple ETF proposals pending approval, covering a diverse range of ETFs. Trump Coin ETF Filing Details The Trump coin ETF is aimed at providing institutional access to the $TRUMP token. In the filing, Canary notes that the fund enables investors to purchase $TRUMP without actually owning the memecoin. This eliminates technical entry obstacles, with a traditional brokerage platform being used instead. Source: sec.gov The S-1 document sets the stage in pace for the next level 19b-4 filing. After submission, the SEC will initiate the official process of reviewing the proposed change in rules. The CSC Delaware Trust Company has been listed as the trustee, but Canary has not specified a custodian. The Trump coin ETF becomes part of the increasing number of memecoin ETFs registered under the 1933 Securities Act. According to Bloomberg analyst James Seyffart, this is the first-ever official spot filing under the 33 Act for $TRUMP. The other applications of Rex-Osprey and Tuttle followed the format of the 1940 Act. Canary is also in the background of the upcoming PENGU ETF listing. Elsewhere, major companies such as Grayscale and Bitwise are pushing for Dogecoin ETFs. The Trump coin ETF now becomes the third meme coin ETF proposed under the 33 Act. Should it be accepted, the Trump coin ETF has the potential to offer an alternative approach to political and meme-related crypto investing. Canary has not revealed anticipated charges or the intended exchange of listing. However, the ETF’s approval could align with broader SEC action on other crypto products by late 2025. More Crypto ETF Filings Add Pressure on SEC The American-Made Crypto ETF, which has been filed under the ticker MRCA, plans to include U.S.-related tokens such as XRP and Solana. It does not include memecoins, stablecoins, and pegged tokens. The ETF will incorporate staking rewards into its NAV using trusted third-party bridges. Custody will be based on cold wallets and is controlled by a South Dakota-based trust company. Meanwhile, the Canary Trump coin ETF may flourish based on recent SEC guidance on staking and custody. Earlier this year, the commission clarified that memecoins such as $TRUMP are not securities. The trend could ease the entry of meme coin ETFs through regulatory hurdles. NEW: The @SECGov Division of Corporation Finance has just put out guidance on memecoins saying they are NOT securities and are akin to collectibles. “It is the Division’s view that transactions in the types of meme coins described in this statement, do not involve the offer… — Eleanor Terrett (@EleanorTerrett) February 27, 2025 Canary Capital already has other filings under consideration. These consist of products based on Solana, XRP, TRX, SUI, and PENGU. Most of the crypto-based ETFs also have had their SEC rulings delayed, with big decisions now moving into October 2025. Market interest is, however, increasing despite the delays. The Trump coin, which was once worth $75, now has a price of $8.38, almost 89% of its peak. It remains one of the six largest memecoins in terms of market capitalization, currently valued at $1.67 billion. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.