ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

40125 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

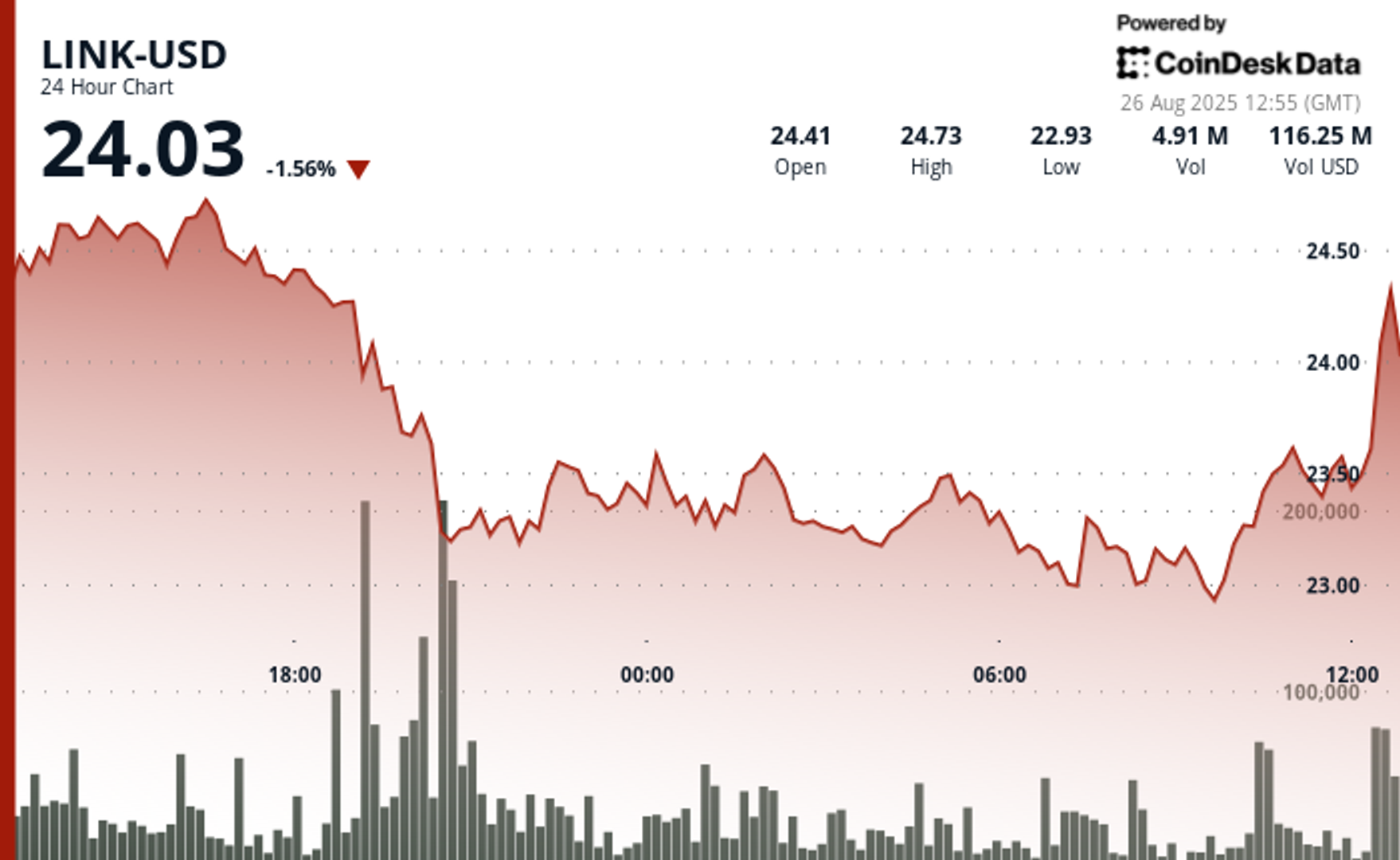

IBKR soars, crypto stocks down

Author: BitcoinEthereumNews

2025/08/26

Share

Recommended by active authors

Latest Articles

Why Google Searches for Bitcoin Are Spiking During Market Volatility

2026/02/07 23:15

XRP Is The ‘Oxygen’ Of The New Financial System, CEO Says

2026/02/07 23:13

Zcash Security Strengthens as Vitalik Buterin Funds Crosslink Upgrade

2026/02/07 23:00

Top 3 Crypto Opportunities This Month: One New Protocol Stands Out

2026/02/07 22:56

What crashed Bitcoin? Three theories behind BTC's trip below $60K

2026/02/07 22:44