Index

Share

A crypto Index provides a way for investors to gain diversified exposure to a specific basket of digital assets through a single tokenized product. These indices often track specific sectors, such as DeFi, DePIN, or RWA, and are automatically rebalanced via smart contracts. In 2026, AI-managed thematic indices have become the gold standard for passive investing, allowing users to track the "blue chips" of the Web3 economy without manual portfolio management. This tag covers index methodology, rebalancing frequency, and the benefits of diversified crypto baskets.

25823 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Robinhood (HOOD) Stock Jumps 14% on Market Rally and Analyst Upgrades

2026/02/07 20:44

Pi Network Targets Open Mainnet 2026, Millions Prepare as Utility and Migration Accelerate

2026/02/07 20:41

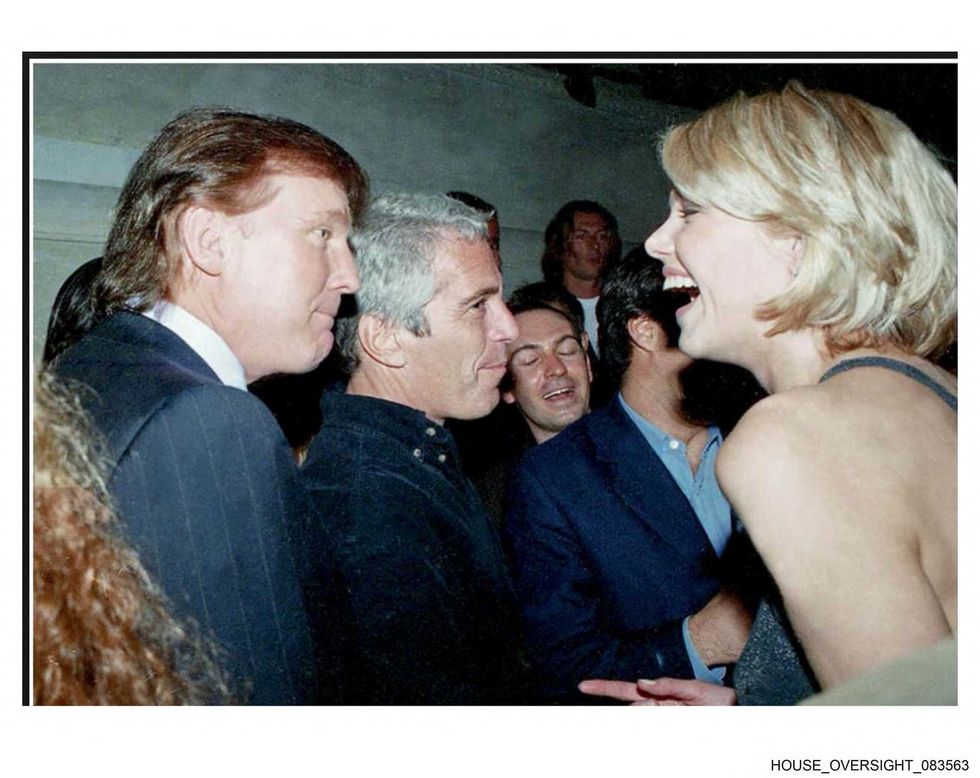

Trump named in explosive tip regarding Epstein’s death: ‘Authorized murder’

2026/02/07 20:37

Trump Administration Approves New Crypto-Friendly Bank

2026/02/07 20:37

XRP eyes $3 amid whale buying – Reversal or relief rally?

2026/02/07 20:19