Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

14288 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

RecycleNation Ranked #1 Among the World’s Top Online Recycling Resources on the Web for 2026

2026/02/05 02:46

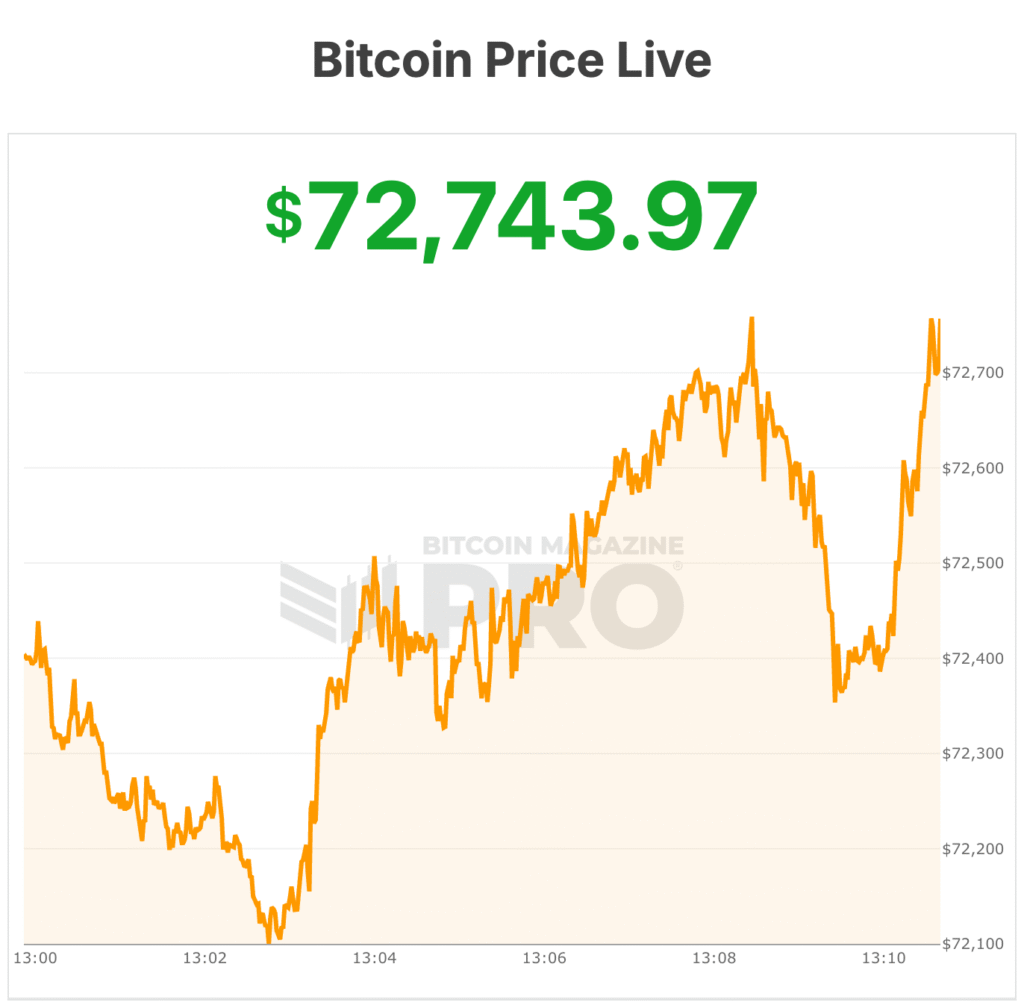

Strategy ($MSTR) Shares Sink Over 20% in 5 Days as Bitcoin Crashes to $72,000

2026/02/05 02:15

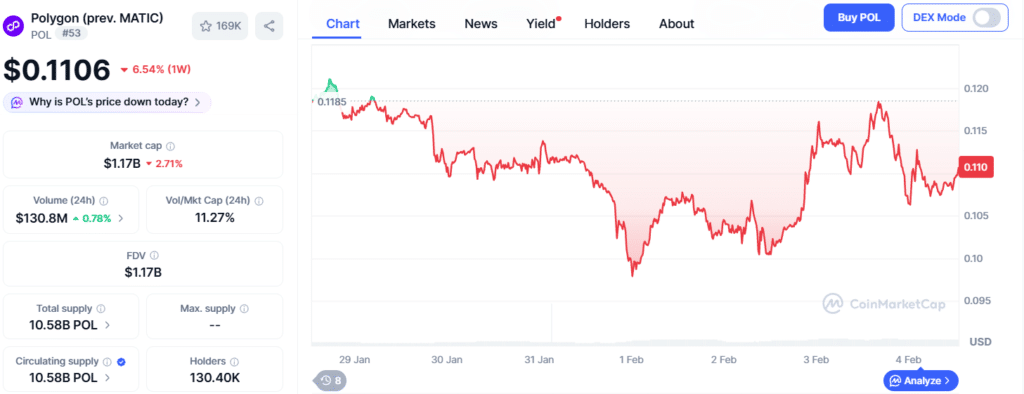

Polygon Price Analysis: Can POL Hold $0.10 Support Level?

2026/02/05 02:00

Tanduay reenters the brandy market with Torres Brandy

2026/02/05 00:04

We had a lot, not a little, lamb

2026/02/05 00:02